11 Dec 2025

Software valuation update – Q3 2025

After two strong quarters, Q3 marked a valuation reset, driven by investor focus on profitability over pure growth. Multiples have converged, rewarding companies that exceed the Rule of 40 benchmark. ERP and HCM illustrate resilience through stickiness and talent-driven demand, while CRM remains the long-term growth leader despite short-term volatility.

For entrepreneurs, balancing growth with margin is now critical to sustain premium valuations, while investors and PE firms should expect continued discipline and position portfolios for a two-speed market. Software remains structurally attractive, but quality – not category hype – will likely lead the way in the near future.

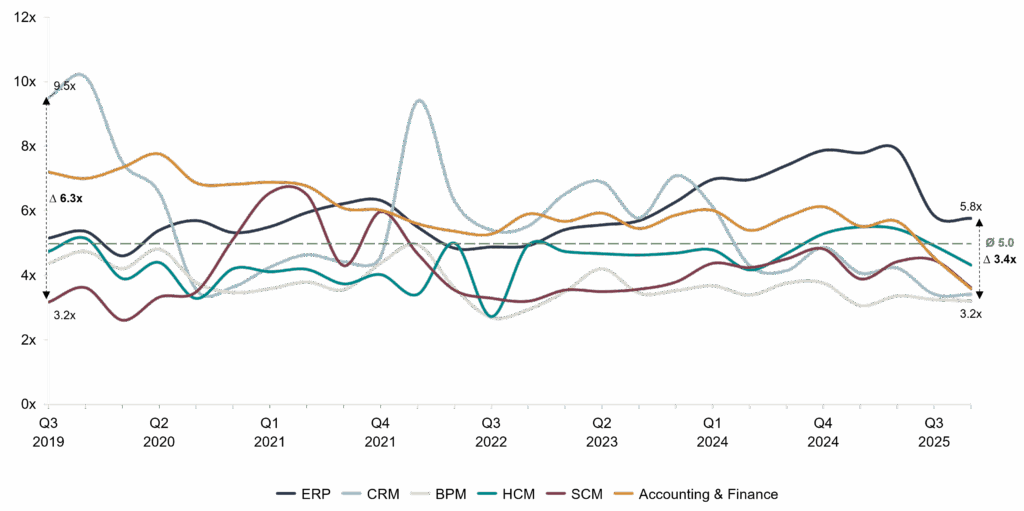

EV/Revenue Development by sub sector: Q3 2019 – Q3 2025

A few takeaways from the last years:

- Valuation spread narrowed from over 6.0x to less than 3.5x, i.e. sub sectors´ valuations are converging and experience fewer spikes.

- Valuation spreads narrowed as higher rates and the end of “growth at any cost” pulled down high-growth names while profitable sub sectors held up. As business models and KPIs converge, investors apply more uniform lenses, compressing multiples across sub sectors.

- Over time, the overall software market was valued on average at 5.0x, the average trading bandwidth lays between 4.0x and 6.5x.

- On a sub sector level, all six sub sectors are currently trading below their historical five year average valuation, while market forecasts indicate an upward trend over the next five years (see Enterprise Software Market 2025-2030); among other things, driven by usual expectations of capital market investors of mean reversion patterns.

- ERP currently shows the highest revenue multiple at 5.8x, trading above the overall average and illustrating continued investor confidence in core platforms, supported by high customer stickiness and resilient margins.

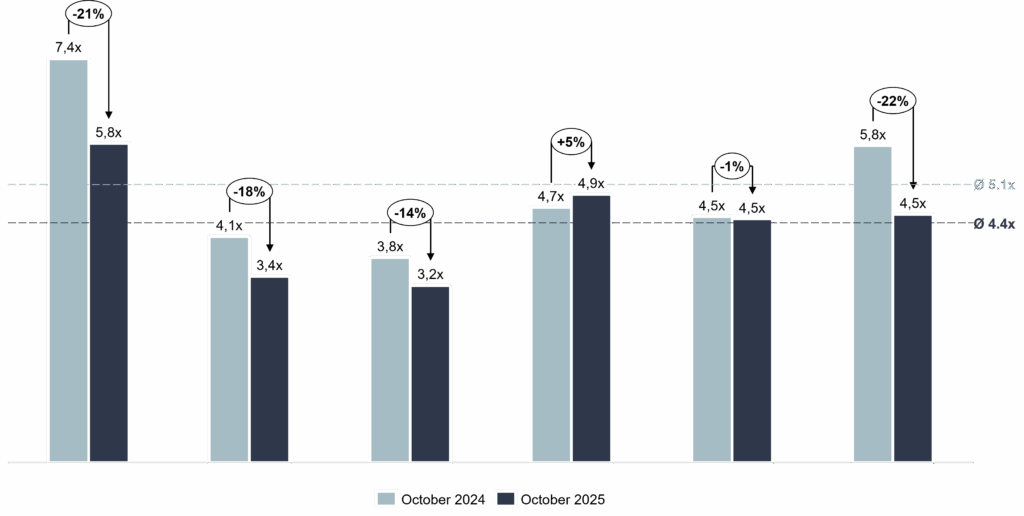

EV/Revenue: YoY comparison 10/2024 – 10/2025

- ERP (-21%), CRM (-18%), BPM (-14%) and Accounting & Finance (-22%) experienced the most pronounced reset– driven by softer growth prospects and a sharper investor focus on profitability.

- SCM remained stable (-1%), indicating a largely unchanged market view on supply-chain software fundamentals.

- HCM is the only sub sector with positive momentum (+5%), in light of scarcity of talent and remote work as likely drivers, reflecting continued demand for efficient and effective workforce and talent management solutions.

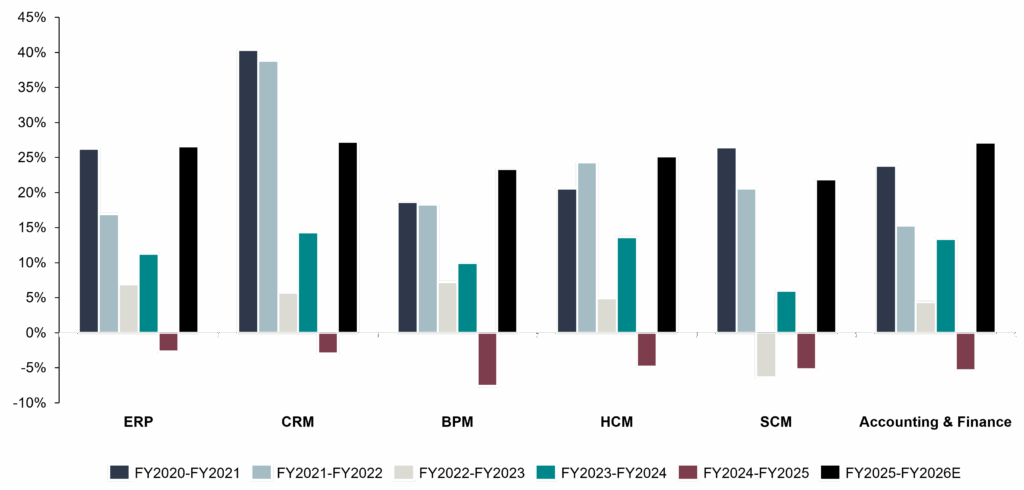

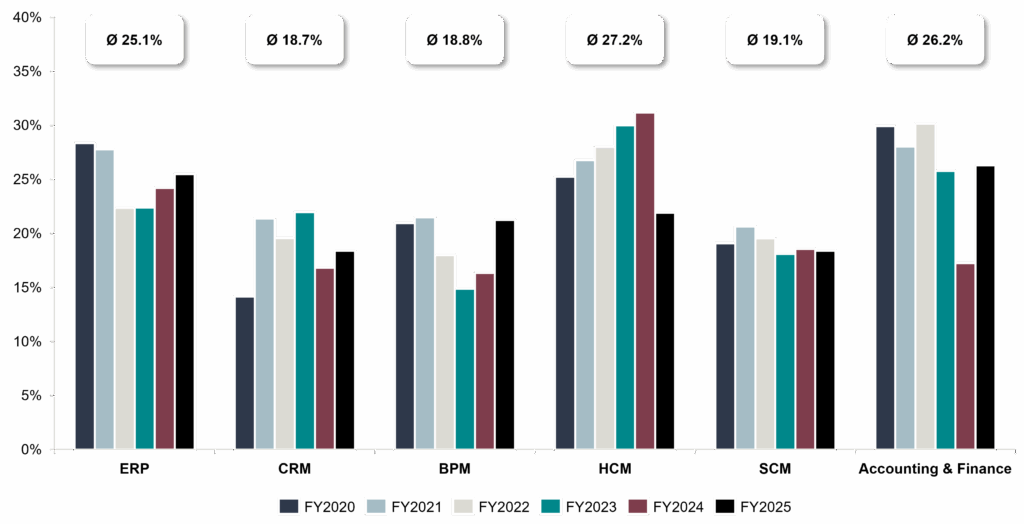

Revenue growth in % by sub sector: 2020 – 2026E

- CRM maintains the strongest long-term growth trajectory, reaching a forecasted growth of >25% in FY2026E

- BPM is the most volatile segment, contracting in FY2024–FY2025 before rebounding as workflow automation investments recover, reflecting its exposure to capex cycles and larger projects that are currently being pursued more cautiously, if at all

It’s a two-speed market: fast-growing sub sectors (CRM, HCM, A&F) lead the pack, while foundational platforms (ERP, SCM, BPM) show steadier, more cyclical growth.

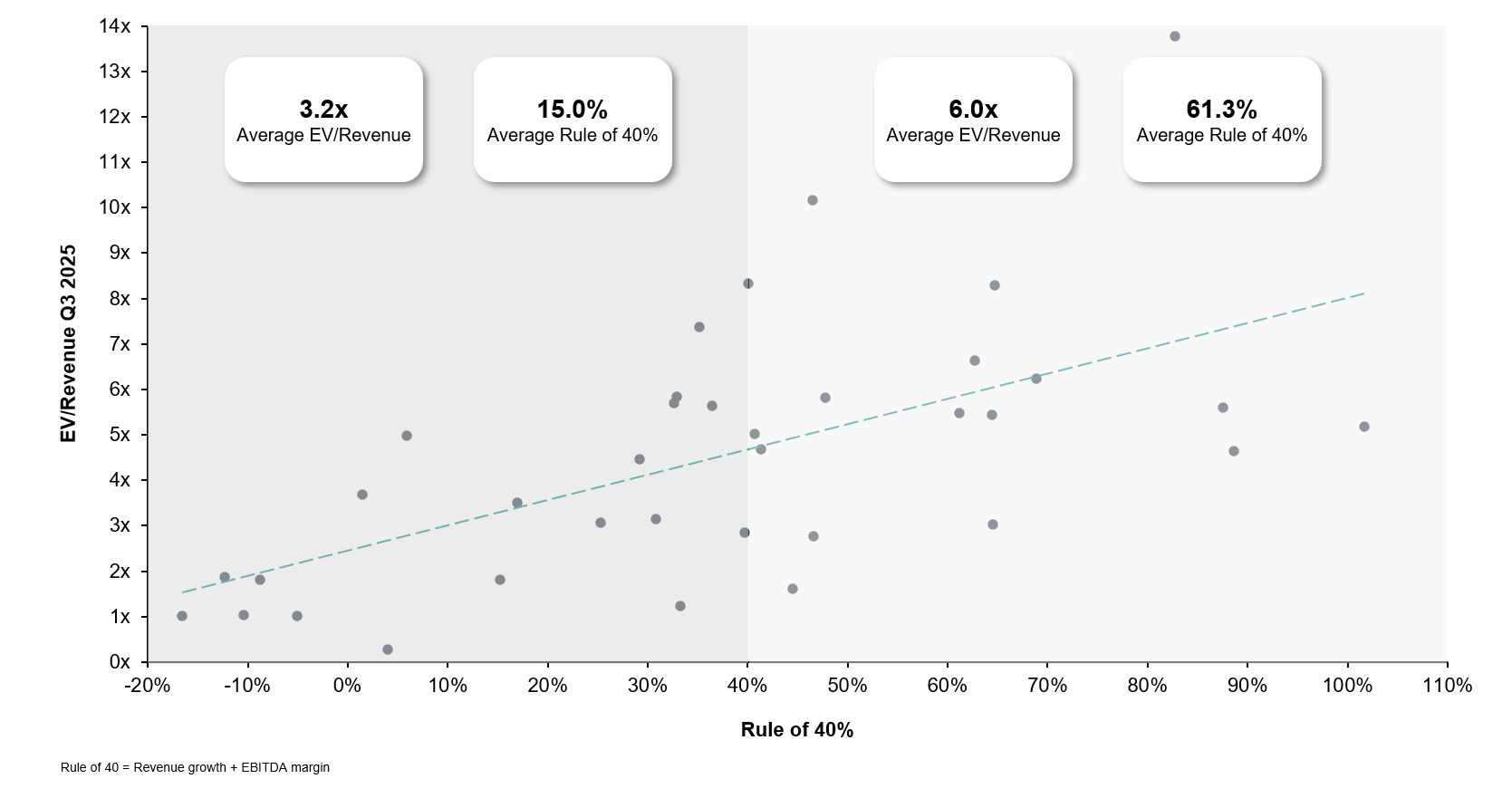

Software Valuation Framework: The Rule of 40

- There is a clear positive link between Rule of 40 performance and EV/Revenue multiples, signalling that investors continue to reward a strong balance of growth and profitability– with a growing bias towards margin quality and capital-efficient growth in the current higher-rate, capital-scarce environment

- Companies below the 40% threshold cluster at lower valuation ranges, averaging 3.2x EV/Revenue and a 15% Rule of 40 score

- In contrast, companies exceeding the 40% benchmark achieve significantly higher valuations, averaging 6.0x EV/Revenue with a strong 61% Rule of 40 performance.

- The upward trendline underscores that high-quality software companies – those pairing strong growth with solid margins – command a clear valuation premium.

EBITDA-margin by sub sector: 2020 to 2025 (in %)

- ERP maintains strong and stable profitability, with margins consistently in the 22-28% range and a sector average of 25.1%, reflecting high standardisation and robust customer retention. Systems are deeply rooted in the organizations, high margins are achievable.

- SCM remains the lowest-margin category with averages around 19.1%, reflecting heavier integration requirements and lower pricing power.

Profitability is most resilient in standardised, sticky sub sectors (HCM, A&F, ERP), while CRM, BPM, and SCM face structurally thinner margins due to integration and service intensity.

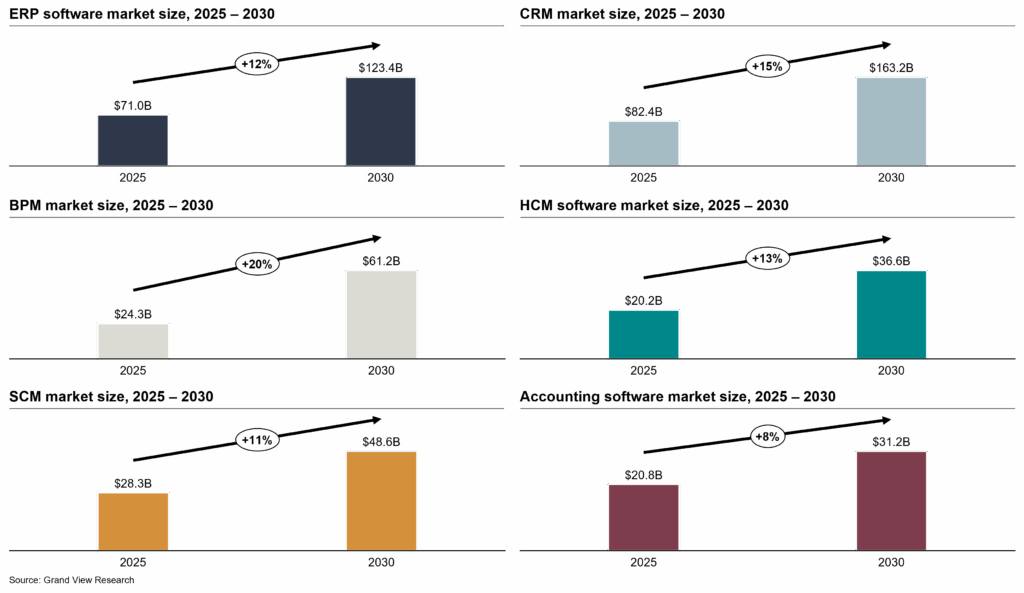

The Enterprise Software Market by sub sector, 2025-2030

- The overall enterprise software market almost doubles from $247bn (2025) to $464bn (2030) (~13.5% CAGR)

- ERP ($71bn) and CRM ($82.4bn) remain the largest sub sectors, supported by digital transformation and embedded AI

- BPM is the fastest-growing segment, expected to grow at ~20% CAGR to $61.2bn, reflecting a shift toward workflow orchestration and automation

- SCM (11% CAGR) and HCM (13% CAGR) also expand strongly as firms focus on supply-chain resilience and workforce optimization

- Accounting software grows slower (8% CAGR), indicating a more mature, commoditized market

Overall, process- and automation-centric sub sectors (BPM, CRM, ERP) are positioned to capture disproportionate value.

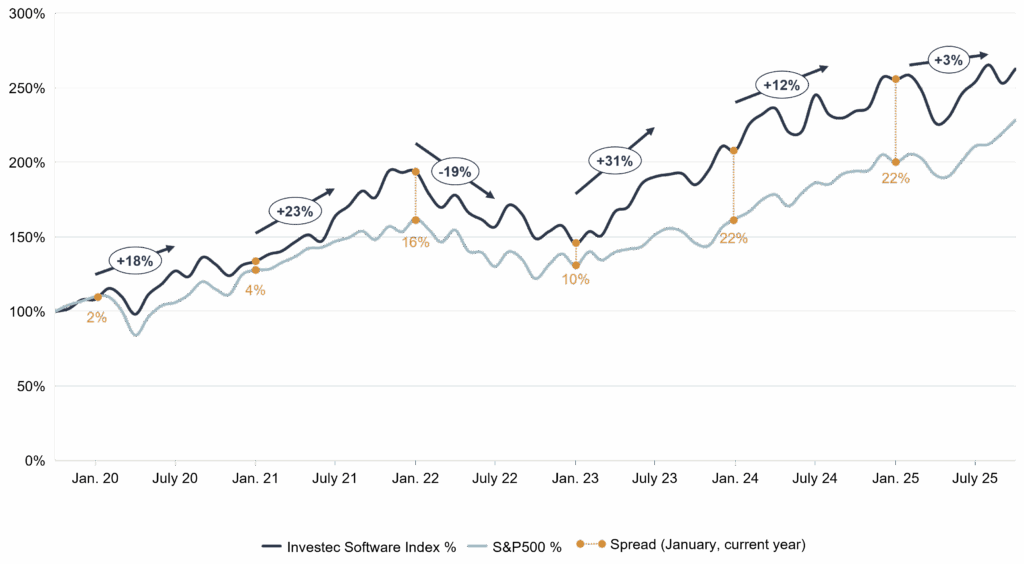

Investec Software Index vs. S&P500

- The Investec Software Index has consistently outperformed the S&P 500, reflecting not only the sector’s superior long-term growth profile but also the resilience of sticky, recurring-revenue models and stable margins, particularly in periods of macro uncertainty such as COVID-19

- Key Highlights include:

- With a positive January spread (highlighted in orange) in most years, ranging from 4% to 22%, underscores the sector’s ability to sustain a clear valuation premium versus the broader market.

- Overall, the index trend confirms that software remains a structurally attractive asset class, supported by durable growth, high-margin economics, and sustained investor demand.

Would you like to learn more about valuations, buyer activity and current opportunities in the market?

We would be happy to schedule a call to discuss further.

Find out more on our website at https://www.investec.com/advisory/sector-expertise/tmt/